The journey to financial wellness often begins not with a higher salary, but with a clearer plan. Money management worksheets are the foundational tools that transform abstract financial anxiety into a structured, actionable strategy. For students, young professionals, and anyone feeling overwhelmed by their cash flow, these worksheets provide a tangible path forward.

They answer the critical question of ‘how to create a budget’ by breaking down an intimidating process into manageable, sequential steps. This guide offers more than just theory; it provides a proven framework, backed by financial principles and expert wisdom, to help you build a budget that actually works for your life.

By engaging with these worksheets, you move from being a passive observer of your finances to an active, empowered manager, ready to make informed decisions that pave the way to achieving your most ambitious financial goals.

Key Takeaways

- Active Engagement Leads to Deeper Understanding: The physical or digital act of writing down numbers fosters a stronger cognitive connection to your finances than passive app notifications, leading to greater accountability and awareness.

- Unmatched Customization and Flexibility: A generic app category might be “Dining,” but your worksheet can have “Work Lunches,” “Date Nights,” and “Coffee Runs,” allowing for precise tracking that reflects your actual lifestyle. This makes it the ultimate personalized budget template.

- Comprehensive Financial Clarity: These tools provide both a macro view (annual net worth growth) and a micro view (weekly grocery spending), answering ‘what does a budget show you’ in exhaustive detail. This clarity is the first step toward genuine control.

- The Cornerstone of Financial Discipline: The consistent ritual of updating a worksheet cultivates fiscal discipline, making the challenge of ‘how to make a budget and stick to it’ a habitual and rewarding practice rather than a burdensome chore.

Table of Contents

Beyond Digital Apps: The Tangible Power of a Purpose-Built Budget Worksheet

In an era dominated by financial technology, the humble worksheet might seem antiquated. However, its perceived simplicity is its greatest strength. While budgeting apps excel at automation and aggregation, they often create a layer of separation between you and your money. Transactions are categorized by algorithms, and spending is summarized in charts, requiring minimal active engagement.

This passivity can be a pitfall. A budget worksheet, whether a printable PDF or a digital spreadsheet, demands participation. This manual process of recording and categorizing expenses forces a moment of reflection that an automatic bank feed simply cannot replicate. It is in this moment—the pause between making a purchase and logging it—that mindfulness is built.

This hands-on approach is particularly effective for those who feel overwhelmed, as it demystifies finances by turning a large, complex problem into a series of small, simple tasks. For anyone learning how to budget money, this foundational, tactile experience is invaluable for building lasting financial intuition.

Establishing Your Financial Baseline: The Imperative of the Net Worth Snapshot

Embarking on a financial plan without understanding your starting point is like embarking on a road trip without a map. The Net Worth Snapshot worksheet is that essential map. It is the most comprehensive diagnostic tool in personal finance, providing a single number that encapsulates your entire financial health at a given moment.

Net Worth Calculator

The calculation is elegantly simple: Total Assets (What You Own) – Total Liabilities (What You Owe) = Net Worth. This exercise is not designed to induce shame or pride but to establish an objective, quantitative baseline from which all progress can be measured. Assets include liquid funds (checking/savings accounts), invested funds (retirement and brokerage accounts), and tangible assets (like your home or car, using their realistic market value). Liabilities encompass all forms of debt: credit card balances, student loans, auto loans, mortgages, and personal loans.

The profound power of this worksheet lies in its ability to shift your perspective from a narrow focus on monthly cash flow to a broader view of long-term wealth building. A positive and growing net worth is the ultimate indicator of financial success, far more telling than a high salary alone.

By updating this snapshot quarterly, you create a powerful feedback loop. For instance, a young professional might see a negative net worth due to student loans initially, but watching that number creep steadily upward—even by small amounts — provides immense motivation and validates the daily discipline of sticking to a budget. It answers the question ‘what can a budget help you do’ on the grandest scale: build lasting wealth.

Architecting Your Finances: A Deep Dive into the Zero-Based Budget Worksheet

The zero-based budget (ZBB) is the cornerstone of intentional financial planning, and its dedicated worksheet is the architect’s blueprint. Popularized by financial experts like Dave Ramsey, this method is the definitive answer to ‘what is the best way to create a budget.’

The core principle is meticulous: your income minus your expenses must equal zero. This does not imply spending every dollar frivolously; rather, it means assigning every single dollar a specific and purposeful job—whether that job is paying rent, buying groceries, saving for a down payment, or investing for retirement. This methodology eliminates “miscellaneous” or unallocated funds, which are often the black holes where financial discipline dissipates.

Implementing a ZBB with a worksheet is a deliberate process. It begins with a precise calculation of your monthly take-home pay—the actual amount that hits your bank account.

The next phase involves cataloging every conceivable expense. Fixed expenses like rent and car payments are easy. Variable expenses like groceries, gas, and entertainment require estimation based on past spending, which is where tracking comes in.

The critical phase is the allocation: subtracting all planned expenses from your income. A surplus isn’t a cause for celebration but an opportunity for optimization—that extra $50 could accelerate debt payoff or boost an emergency fund.

A deficit necessitates a rigorous review of variable and discretionary spending categories. This process, while demanding, provides unparalleled clarity and control, directly addressing ‘how can creating a budget help with overspending’ by forcing you to make conscious trade-offs before the money is even spent.

Zero-Based Budget for a Young Professional

| Income | Amount | Expense Category | Budgeted Amount | Notes |

| Primary Job | $4,500 | Rent | $1,400 | |

| Utilities | $200 | Internet, Electric, Water | ||

| Groceries | $450 | |||

| Transportation | $300 | Gas, Public Transit Pass | ||

| Debt Repayment | $600 | Student Loans | ||

| Savings | $800 | Emergency Fund & Roth IRA | ||

| Insurance | $150 | Health, Renter’s | ||

| Entertainment | $250 | Dining Out, Subscriptions | ||

| Personal | $350 | Clothing, Gifts, Misc. | ||

| Total | $4,500 | Total | $4,500 | Every Dollar Has a Job |

Synchronizing Cash Flow: Mastering the Paycheck Budget Template

For individuals not on a standardized monthly salary, particularly those with bi-weekly paychecks or variable income from freelancing, a single monthly budget can feel abstract and out of sync with reality. The paycheck budget template is the essential tool that solves this dissonance by aligning your budget directly with your pay cycle.

This method involves deconstructing your master zero-based budget into smaller, more manageable chunks that correspond with each paycheck you receive. This is the practical application of ‘how to budget money’ for the real world, preventing the common scenario where the first paycheck of the month is spent too freely, leaving the second paycheck to desperately cover all remaining bills.

The process is one of proportional allocation. If your monthly rent is $1,400 and you are paid bi-weekly (twice a month), you would set aside $700 from each paycheck specifically for rent. This is repeated for every category in your budget. This rhythmic approach creates a disciplined system of “envelopes” for your digital money, ensuring that essential obligations are funded immediately upon receipt of funds.

It transforms budgeting from a monthly retrospective exercise into a proactive, paycheck-by-paycheck strategy. This granular control is a powerful technique for ‘how to stay on budget’ throughout the entire month, as it provides a clear spending plan for each distinct pay period, reducing the temptation to overspend early in the cycle.

The Weekly Financial Pulse Check: Leveraging Your Weekly Budget Worksheet

A monthly budget provides the strategic plan, but without regular tactical check-ins, it’s easy to drift off course. The weekly budget worksheet acts as your financial compass, providing the frequent course corrections needed to reach your monthly destination.

A week is a long time in the world of personal spending; without a mid-month review, a few small, unplanned purchases can snowball into a significant budget breach by month’s end. This weekly ritual, which should take no more than 15-20 minutes, is the heartbeat of any successful financial plan and is critical for understanding ‘how to make a budget and stick to it.‘

The function of this worksheet is to track actual spending against your planned monthly budget, pro-rated for that point in the month. For example, by the end of week one, you should have spent approximately 25% of your monthly allocations in each category. This isn’t about fostering an obsession with every penny but about maintaining crucial awareness. If you notice your “Dining Out” spending is at 40% of its monthly budget after just one week, you have three weeks to consciously adjust your behavior — perhaps by packing lunch more often — to bring the category back in line.

This agile system provides near-real-time feedback, allowing for proactive adjustments rather than reactive panic at the end of the month. It is the ultimate tool for answering ‘how can creating a budget help with overspending’—it catches it early and empowers you to fix it.

Forecasting Financial Obligations: The Strategic Use of a Budget Calendar

The most common derailment of a well-crafted budget is the unexpected—or rather, the unplanned-for—expense. These are not true emergencies but predictable, non-monthly costs that many fail to anticipate: semi-annual car insurance premiums, annual Amazon Prime membership, quarterly property taxes, holiday gift purchases, or vacation savings.

A budget calendar is the strategic tool that transforms these budget-busters from surprises into planned line items. This forward-looking practice fundamentally changes the answer to ‘how often should you create a budget’—while you create a new plan each month, you are informed by an annual vision.

The implementation is straightforward but powerful. First, conduct an annual review of your bank and credit card statements to identify all irregular expenses. List each one, its due date, and its total annual cost.

Second, calculate the monthly savings required for each item. For example, a $600 annual insurance premium means setting aside $50 each month. Third, treat this savings amount as a non-negotiable monthly expense in your zero-based budget, transferring it to a dedicated savings account immediately upon getting paid. Finally, mark these due dates prominently on your budget calendar. This process of “sinking funds” ensures that when the bill arrives, the money is already waiting for it, stress-free. This proactive planning is a hallmark of advanced financial management and is crucial for maintaining annual budget integrity.

From Theory to Practice: The Mechanics of Adherence and Accountability

Creating a perfect budget worksheet pdf is a theoretical exercise unless it is accompanied by a system for consistent adherence. The chasm between intention and action is where most financial plans fail. Bridging this gap requires building accountability and turning budgeting into a sustainable habit, not a periodic purge. This involves designing a system that works for you.

For some, this means carrying a small notebook for on-the-go receipt tracking. For others, it’s a dedicated notes app on their phone for logging transactions in real-time. The chosen method is less important than the consistent practice of then transferring that raw data into your master worksheets during your weekly check-in.

The monthly reconciliation meeting with yourself is perhaps the most valuable step. At the end of each month, before building the next month’s budget, review the old one. Conduct a post-mortem: Where did you exceed expectations? Where did you fall short? Most importantly, ask why. Was the budget for “Eating Out” unrealistically low for your social life, or did you simply lapse into old habits?

This reflective practice transforms your worksheets from mere tracking tools into powerful learning instruments. They become a logbook of your financial behavior, providing the data-driven insights needed to create increasingly realistic and effective budgets. This cycle of plan, track, review, and adapt is the engine of lasting financial change.

Tailoring Your Toolkit: Specialized Planners for Targeted Financial Goals

The true versatility of the worksheet system is revealed when it is applied to specific financial aspirations beyond monthly cash flow management. While a general monthly budget template handles everyday life, specialized budget planners are the scalpels for precise financial surgery.

Consider a travel budget template. This tool forces you to plan for every aspect of a trip—flights, accommodation, meals, activities, and souvenirs—before you depart. By researching and allocating costs upfront, you can enjoy your vacation without the underlying anxiety of overspending or the dreaded credit card statement shock upon return. This proactive planning is the difference between a trip that creates cherished memories and one that creates financial stress.

Similarly, a dedicated debt payoff worksheet is invaluable for tackling liabilities. Methods like the debt snowball (paying smallest debts first for psychological wins) or the debt avalanche (paying highest-interest debts first for mathematical efficiency) can be mapped out on a worksheet.

Charting your starting balance and tracking every payment provides a visual representation of your progress that is incredibly motivating. Watching a chart line trend downward toward zero is a powerful reinforcement of your efforts. Other specialized templates could include a home renovation planner, a wedding budget, or an investment tracking sheet. These tools empower you to approach any significant financial undertaking with the same level of organization and confidence as your monthly budget.

Sample Travel Budget Template for a 5-Day Domestic Trip

| Expense Category | Estimated Cost | Actual Cost | Notes & Booking Details |

| Flights | $300 | $275 | Booked 2 months in advance |

| Accommodation | $600 | $600 | Hotel |

| Rental Car | $200 | $220 | Added insurance |

| Food & Dining | $400 | $450 | One fancy dinner exceeded budget |

| Activities | $150 | $120 | |

| Souvenirs | $100 | $75 | |

| Total | $1,750 | $1,740 | Under Budget! |

our Action Plan: Accessing and Implementing Your Printable Toolkit

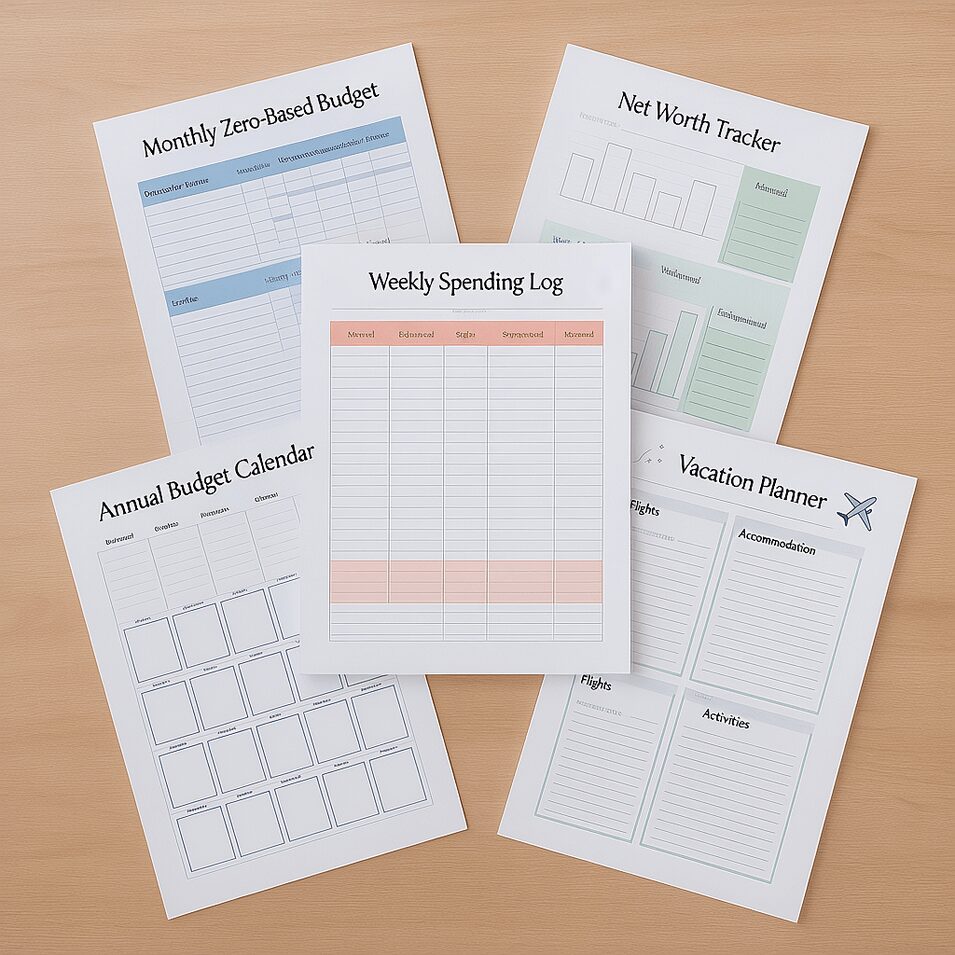

Understanding the principles of effective money management is the first step; implementing them with the right tools is the crucial next one. To facilitate immediate action, we have compiled a comprehensive kit of printable budget sheets designed to work together as the integrated system described in this article.

This kit includes a Net Worth Snapshot worksheet to establish your baseline, a Zero-Based Monthly Budget Template for your overarching plan, a Paycheck Budget Template for syncing with your pay cycle, a Weekly Budget Worksheet for tracking your pulse, a Budget Calendar for forecasting irregular expenses, and a Travel Budget Template for special goals. These printable budget worksheet PDFs are formatted for clarity and ease of use, whether you prefer to fill them out digitally or print them and write by hand. The barrier to entry is now removed. The path from financial anxiety to financial confidence is literally a download away.

Conclusion

Financial security is not an accident or a privilege reserved for high earners. It is the direct result of intentional, informed, and consistent habits. Money management worksheets are the physical embodiment of these habits. They provide the structure to convert feeling overwhelmed into feeling in command, to turn questioning where your money went to directing where it will go next.

By adopting this step-by-step system — from the foundational net worth assessment to the detailed zero-based budget, supported by weekly tracking and annual forecasting — you equip yourself with more than just tools; you gain the clarity and confidence to make your financial goals an inevitable reality. The framework is here. The knowledge is yours. The next step is to begin.

Frequently Asked Questions

What is the best way to create a budget?

The most effective and recommended method by financial experts is zero-based budgeting using a dedicated worksheet. This approach ensures every dollar of your income is assigned a specific purpose—whether for expenses, savings, or debt repayment—eliminating wasteful and unaccounted-for spending and providing maximum clarity and control over your cash flow.

How often should you create or review a budget?

You should create a new budget at the beginning of every month to account for changing income and expenses. However, this monthly budget should be reviewed on a weekly basis to track spending and make necessary adjustments. Furthermore, your monthly plans should be informed by an annual perspective using a budget calendar to plan for irregular expenses.

How can creating a budget help with overspending?

A budget acts as a proactive spending plan and an early detection system. By comparing your actual weekly spending against your planned budget, you can identify trends of overspending in specific categories early in the month. This allows you to consciously adjust your behavior in other areas to compensate, preventing a minor overspend from becoming a major budget deficit. It creates mindfulness around spending.

What does a budget show you about your finances?

A comprehensive budget provides a complete financial picture. It shows your total income, your detailed spending patterns across numerous categories, your progress toward savings and debt payoff goals, and ultimately, whether you are living within your means. It turns abstract anxiety into concrete, actionable data, revealing both strengths and vulnerabilities in your financial habits.

Where can I find a reliable and free budget worksheet PDF?

Many reputable financial websites and institutions offer free, printable budget worksheet PDFs. Our curated collection, designed specifically to work together as the integrated system described in this article, is available for download. It includes a monthly budget template, weekly tracking sheets, a budget calendar, and specialized planners, providing everything you need to start.

What should a useful budget actually look like?

A useful budget should be clear, comprehensive, and personalized. It should have distinct sections for all income sources and detailed, customized categories for expenses (fixed, variable, and savings for irregular expenses). Its layout should be logical and easy for you to use and understand. The best budget is not the most complex one, but the one you will consistently use and maintain.

Robert Martin is a passionate blogger and versatile content creator exploring the intersections of personal finance, technology, lifestyle, and culture. With a strong background in financial literacy and entrepreneurship, he helps readers make smarter money moves, build sustainable side hustles, and achieve financial independence.

Beyond finance, Robert shares his insights on home decor and gardening—offering practical ideas for creating beautiful, functional living spaces that inspire comfort and creativity. He also dives into the dynamic worlds of sports and celebrity news, blending entertainment with thoughtful commentary on trends that shape today’s pop culture.

From decoding the latest fintech innovations to spotlighting everyday success stories, Robert delivers content that’s informative, relatable, and actionable. His mission is to empower readers to live well-rounded, financially confident lives while staying inspired, informed, and ahead of the curve.