Understanding the average cost of clothing per month for 1 person requires examining multiple interconnected factors that influence individual spending patterns. From income levels to lifestyle choices, numerous variables determine whether someone spends $50 or $500 monthly on apparel.

This comprehensive analysis explores the key determinants shaping clothing expenses for single-person households, providing actionable insights for budget-conscious consumers navigating today’s complex retail landscape.

Key Takeaways

- The average American spends between $120-$161 per month on clothing, with significant variation based on income and lifestyle

- Income level is the strongest predictor of clothing expenses, typically representing 3-5% of net monthly income

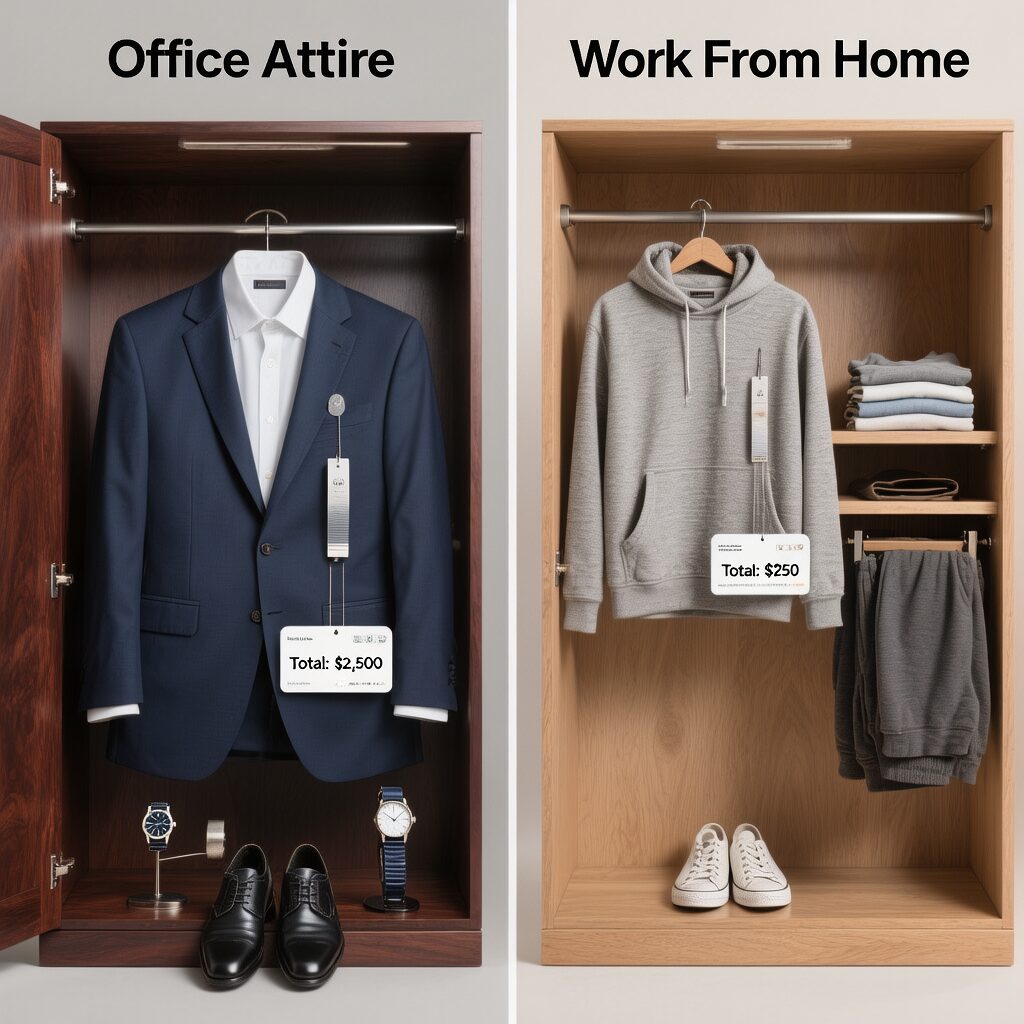

- Professional requirements can increase clothing costs by 40-80% compared to casual lifestyle needs

- Seasonal fluctuations cause 25-40% variations in monthly clothing expenditures throughout the year

- Quality-focused purchasing strategies often reduce long-term costs despite higher upfront investments

- Geographic location affects clothing costs by up to 30% due to climate and local pricing variations

- Age demographics show distinct spending patterns, with peak clothing expenses occurring between ages 25-45

Table of Contents

The Foundation of Modern Clothing Expenditure: National Averages and Regional Variations

The Bureau of Labor Statistics Consumer Expenditure Survey reveals that American consumers allocate approximately $1,866 annually on apparel, translating to roughly $155 monthly per person. However, this baseline figure masks substantial variations that reflect the complex reality of modern clothing consumption patterns across diverse demographic segments and geographic regions.

Regional cost disparities significantly impact the average clothes cost per month for individuals across the United States. Metropolitan areas like New York City, San Francisco, and Los Angeles exhibit clothing costs ranging from 25% to 35% above national averages, primarily due to higher retail rents, premium brand concentration, and elevated local purchasing power.

These urban centers create fashion ecosystems where designer boutiques, high-end department stores, and luxury retailers dominate the retail landscape, naturally driving up average clothing prices. Conversely, rural communities and smaller metropolitan areas often experience clothing costs 15% to 20% below national averages, reflecting lower operational costs for retailers, reduced brand competition, and different consumer expectations.

Climate considerations further complicate regional spending patterns, creating substantial variations in annual clothing budgets based on geographic location. Northern states requiring comprehensive winter wardrobes face additional expenses of $200 to $400 annually compared to temperate regions, as residents must invest in heavy coats, insulated boots, warm accessories, and layering pieces.

For instance, a Minneapolis resident might spend $300 on a quality winter coat that lasts five years, while a Phoenix resident may never need such an investment. Conversely, year-round warm climates necessitate frequent replacement of lightweight garments due to increased wear frequency, sun exposure, and higher washing requirements, creating different but equally significant budgetary pressures.

The retail infrastructure within different regions also influences clothing costs substantially. Areas with limited retail competition often see higher prices due to reduced consumer options, while regions with diverse shopping alternatives including outlet malls, discount retailers, and online fulfillment centers typically offer more competitive pricing structures. Transportation costs for merchandise distribution, local taxation policies, and regional wage structures all contribute to the final pricing consumers encounter in their local markets.

Income Level Impact: Understanding How Earnings Drive Your Clothing Budget

Income represents the primary determinant of individual clothing budgets, with spending patterns following predictable percentage-based frameworks that financial advisors and consumer behavior experts have identified through decades of research. The relationship between earnings and clothing expenditure reflects not just purchasing power but also lifestyle expectations, professional requirements, and social pressures that accompany different income brackets.

Financial experts consistently recommend allocating 2% to 5% of after-tax income toward clothing expenses, though actual spending often varies significantly from these guidelines based on individual circumstances and priorities. Lower-income households frequently struggle to maintain adequate wardrobes within recommended budget parameters, particularly when facing employment requirements for professional attire. These constraints create a challenging cycle where individuals earning $25,000 to $35,000 annually should theoretically spend $500 to $1,250 on clothing but often find themselves spending $800 to $1,100 to meet basic professional and personal needs, representing a higher percentage of their income than recommended.

Middle-income earners, typically those earning $50,000 to $75,000 annually, often achieve closer alignment with recommended spending percentages while enjoying greater flexibility in their clothing choices. These individuals can invest in higher-quality pieces that provide better long-term value, take advantage of seasonal sales without financial stress, and maintain separate wardrobes for professional and casual occasions. Their clothing budgets of $150 to $200 monthly allow for strategic purchasing decisions that balance immediate needs with long-term wardrobe building.

Higher-income individuals, particularly those earning above $100,000 annually, frequently exhibit clothing expenses exceeding recommended percentages due to professional requirements, social expectations, and discretionary spending capacity. This phenomenon, known as “lifestyle inflation,” can result in clothing budgets consuming 6% to 8% of net income among affluent demographics. A corporate executive earning $150,000 might spend $500 to $750 monthly on clothing, driven by client expectations, networking events, and personal brand considerations that extend far beyond basic wardrobe needs.

| Annual Income Range | Recommended Monthly Budget | Actual Average Spending | Percentage of Income | Professional Impact |

| $25,000-$35,000 | $42-$146 | $67-$92 | 3.2-3.9% | High strain on budget |

| $35,000-$50,000 | $88-$167 | $100-$133 | 3.4-3.8% | Moderate flexibility |

| $50,000-$75,000 | $125-$271 | $150-$200 | 3.6-3.8% | Good balance achieved |

| $75,000-$100,000 | $188-$375 | $208-$267 | 3.3-3.6% | Comfortable spending |

| $100,000+ | $250+ | $292-$417+ | 3.5-5.0%+ | Lifestyle inflation risk |

The psychological aspect of income-based spending patterns cannot be overlooked when analyzing the clothing cost per month across different earning levels. Higher earners often view clothing as an investment in their professional success and personal brand, justifying premium purchases through career advancement potential and social positioning benefits.

Professional Lifestyle Demands: How Career Requirements Shape Monthly Clothing Expenses

Professional environments significantly influence the clothing cost per month for working individuals, creating distinct spending categories that can dramatically alter monthly budgets based on industry expectations, client interaction requirements, and workplace culture norms. The impact of professional requirements extends far beyond simple dress codes, encompassing seasonal variations, geographic considerations, and career advancement strategies that collectively shape wardrobe investment decisions.

Corporate environments typically demand business formal or business casual attire, potentially doubling clothing expenses compared to casual work environments. Legal professionals represent one of the highest-cost categories, with monthly clothing expenses ranging from $200 to $400 due to requirements for high-quality suits, formal accessories, and client-appropriate appearances. A corporate lawyer might invest $800 in a single suit that serves multiple occasions, but maintaining a professional rotation requires several such pieces, plus seasonal variations, formal footwear, and appropriate accessories.

Healthcare workers face unique challenges in professional wardrobe management, spending $150 to $250 monthly on specialized uniforms, comfortable yet professional footwear, and personal clothing for administrative duties. Nurses, for example, require multiple sets of scrubs that withstand frequent washing and potential contamination, while also needing comfortable shoes that provide adequate support during long shifts. Physicians often maintain dual wardrobes, including professional attire for patient consultations and appropriate clothing for hospital environments.

Sales representatives and client-facing professionals typically allocate $180 to $300 monthly for varied professional attire that projects competence and trustworthiness across diverse client interactions. These individuals must balance seasonal appropriateness, regional preferences, and industry expectations while maintaining a fresh, professional appearance that supports their business development efforts. The clothing becomes a tool for success rather than mere personal expression.

Educational professionals, including teachers and administrators, typically spend $100 to $180 monthly on business casual attire that balances professionalism with comfort and durability. Teachers require clothing that withstands active classroom environments while maintaining appropriate authority and respect from students, parents, and colleagues. The seasonal nature of academic calendars also influences purchasing patterns, with summer breaks often providing opportunities for wardrobe updates and professional development that may require specific attire.

Remote workers represent a growing demographic with dramatically different clothing needs, typically spending $50 to $100 monthly primarily on comfortable casual wear and occasional professional pieces for video conferences and client meetings. However, even remote workers must consider the psychological impact of professional appearance on productivity and career advancement, leading many to maintain at least basic professional wardrobes despite reduced daily requirements.

Creative professionals, including designers, marketing professionals, and media workers, often spend $120 to $200 monthly on trendy, expressive pieces that demonstrate their aesthetic sensibilities and industry awareness. These individuals view clothing as part of their professional portfolio, requiring constant updates to reflect current trends and maintain credibility within style-conscious industries.

Seasonal Shopping Cycles: Navigating Weather-Driven Wardrobe Fluctuations

Seasonal clothing needs create predictable yet significant fluctuations in monthly expenses, with autumn and spring typically representing peak spending periods that can increase individual clothing budgets by 25% to 40% above baseline monthly averages. These seasonal transitions require strategic planning and budgeting to accommodate changing weather patterns, style preferences, and social calendar demands without deriving financial stability.

Autumn spending increases result from multiple converging factors that create perfect storms of clothing-related expenses. Back-to-school and back-to-work wardrobe refreshes dominate September spending as individuals transition from summer casualness to professional autumn requirements. Winter coat and outerwear purchases represent substantial single-item expenses that can consume entire monthly clothing budgets, with quality winter coats ranging from $150 to $500 depending on climate requirements and quality expectations. Boot and cold-weather footwear acquisition adds another significant expense category, as individuals require waterproof, insulated options that provide safety and comfort during harsh weather conditions.

Holiday party attire preparation creates additional autumn and early winter expenses as social calendars fill with professional networking events, family gatherings, and social celebrations requiring appropriate attire. These occasions often demand clothing that falls outside normal professional or casual wear, requiring specific investments in party dresses, formal accessories, and appropriate footwear that may receive limited wear throughout the year.

Spring expenditures typically include comprehensive wardrobe transitions as individuals shed heavy winter layers and embrace lighter-weight clothing options. The seasonal psychological effect of spring renewal often drives increased spending on fresh styles, updated color palettes, and trend-conscious pieces that reflect changing fashion seasons. Summer wardrobe preparation requires investment in appropriate clothing for increased outdoor activities, vacation planning, and warm-weather professional requirements that differ substantially from winter office wear.

Spring shoe and accessory updates represent another significant expense category as winter boots give way to lighter footwear options, and heavy accessories are replaced with seasonal alternatives. The transition period often requires maintaining both seasonal wardrobes simultaneously, effectively doubling closet space requirements and increasing overall clothing inventory investments.

Winter months often see reduced spending due to post-holiday budget constraints, limited social activities requiring new clothing purchases, and the practical reality that heavy winter clothing receives extended wear without replacement needs. However, this reduced spending period provides opportunities for strategic planning and budget recovery that supports subsequent seasonal spending cycles.

Summer spending varies significantly based on vacation plans, climate-specific needs, and outdoor activity requirements that may demand specialized clothing investments. Beach vacations require swimwear, cover-ups, and resort-appropriate clothing that may receive limited annual use but remain essential for specific occasions. Active outdoor pursuits during summer months often require performance clothing investments that serve specific recreational needs while providing appropriate sun protection and moisture management.

Budget-conscious individuals can leverage seasonal patterns through strategic planning that anticipates spending fluctuations and takes advantage of predictable sale cycles. End-of-season clearances provide opportunities to purchase next year’s seasonal clothing at substantial discounts, while mid-season sales offer current-year options at reduced prices. Building transition pieces that work across multiple seasons maximizes wardrobe versatility while minimizing seasonal replacement requirements.

The Quality Investment Strategy: Long-term Value in Modern Fashion Economics

The relationship between garment quality and long-term costs represents a crucial factor in determining sustainable monthly clothing expenses, challenging conventional wisdom about fashion budgeting and revealing the complex economics of modern apparel purchasing decisions. Understanding this relationship empowers consumers to make informed choices that balance immediate affordability with long-term financial efficiency and wardrobe satisfaction.

Fast fashion economic models appeal to budget-conscious consumers through lower initial costs ranging from $10 to $50 per piece, creating immediate affordability that masks higher cumulative expenses over time. These garments typically require frequent replacement due to inferior materials, construction shortcuts, and trend-focused designs that quickly become outdated or physically deteriorated. A typical fast fashion item might provide 3 to 12 months of acceptable wear before requiring replacement due to fabric pilling, color fading, construction failures, or style obsolescence.

The hidden costs of fast fashion extend beyond simple replacement frequency to include increased shopping time, storage requirements for larger quantities of lower-quality items, and the psychological burden of constantly managing a wardrobe that fails to provide consistent satisfaction or reliability. Fast fashion consumers often find themselves trapped in cycles of continuous purchasing that consume more monthly budget allocation than initially planned while providing less wardrobe satisfaction and versatility.

Investment piece strategies require higher upfront costs ranging from $75 to $300 or more per piece but provide superior long-term value through extended lifespans of 2 to 10 years or more, depending on garment type and care practices. Quality construction using superior materials creates garments that maintain appearance, fit, and functionality throughout extended wear periods while often improving with age through natural patina development and shape settling.

A practical cost-per-wear analysis reveals the economic advantages of quality investment strategies across multiple garment categories. Premium jeans costing $120 and lasting four years provide monthly costs of $2.50, compared to $25 fast fashion jeans lasting eight months at $3.12 monthly, representing a 20% cost reduction that compounds across entire wardrobes. This cost differential becomes more pronounced with frequently worn items like basic shirts, professional wear, and outerwear where quality differences significantly impact longevity and appearance retention.

The environmental and ethical considerations of quality-focused purchasing align with growing consumer awareness of fashion industry impacts, creating additional value beyond pure economic calculations. Quality garments typically involve more sustainable production practices, better labor conditions, and reduced environmental impact through decreased replacement frequency and improved recyclability or resale value.

Quality investment strategies require different shopping approaches that emphasize research, timing, and strategic selection over impulse purchasing and trend following. Successful quality-focused consumers develop expertise in fabric recognition, construction evaluation, and brand reliability assessment that enables informed purchasing decisions. They also utilize sale cycles, outlet shopping, and seasonal clearances to acquire quality pieces at reduced prices without compromising standards.

| Item Category | Fast Fashion Cost | Investment Cost | Fast Fashion Lifespan | Investment Lifespan | Monthly Cost Comparison | Quality Benefits |

| Basic T-Shirts | $8-$15 | $25-$45 | 6-12 months | 2-4 years | Fast: $1.25, Investment: $0.78 | Better fit retention, fabric quality |

| Dress Shirts | $20-$35 | $60-$120 | 8-18 months | 3-6 years | Fast: $2.33, Investment: $1.67 | Professional appearance, durability |

| Casual Pants | $15-$30 | $50-$100 | 6-15 months | 2-5 years | Fast: $2.00, Investment: $1.67 | Comfort, fit consistency |

| Winter Coats | $40-$80 | $150-$400 | 1-3 years | 5-15 years | Fast: $2.67, Investment: $2.22 | Weather protection, style longevity |

| Dress Shoes | $25-$60 | $100-$300 | 6 months-2 years | 5-20 years | Fast: $4.17, Investment: $1.67 | Comfort, repairability |

The psychological benefits of quality investment strategies include increased wardrobe confidence, reduced decision fatigue, and improved personal style consistency that supports professional and personal goals. Quality garments typically fit better, feel more comfortable, and provide greater versatility in styling options, creating wardrobe efficiency that extends beyond pure economic considerations.

Strategic Shopping Behaviors: How Purchasing Patterns Determine Monthly Spending

Individual shopping behaviors significantly influence monthly clothing expenditures, creating distinct spending patterns that can vary by 25% to 50% based on planning approaches, emotional triggers, and purchasing strategies employed by consumers. Understanding these behavioral patterns provides insight into optimizing clothing budgets while maintaining wardrobe satisfaction and meeting practical needs.

Planned purchase approaches represent the most financially efficient shopping strategy, typically resulting in 20% to 35% average monthly savings compared to impulse-driven alternatives. These consumers engage in quarterly or seasonal shopping sessions with specific item identification before entering retail environments, budget allocation and adherence strategies, and research-driven decision making that evaluates options across multiple retailers and price points. Planned shoppers often maintain running lists of needed items, monitor sale cycles for optimal timing, and evaluate cost-per-wear potential before making purchasing decisions.

The research component of planned purchasing includes fabric content evaluation, brand reputation assessment, size and fit analysis across different manufacturers, and long-term wardrobe integration planning that ensures new purchases complement existing pieces while filling genuine gaps in clothing coverage. Planned shoppers often develop expertise in retail calendars, understanding when specific categories typically go on sale and timing major purchases accordingly to maximize value.

Impulse-driven approaches typically result in 25% to 50% monthly overspending compared to planned strategies, despite often involving smaller individual purchases that seem reasonable in isolation. Emotional or situational buying triggers create purchasing decisions that bypass rational evaluation processes, leading to acquisitions that may duplicate existing wardrobe items, fail to integrate with current clothing, or serve limited practical purposes within overall wardrobe strategies.

The psychological aspects of impulse purchasing often involve retail therapy behaviors, social pressure responses, or lifestyle aspiration purchases that reflect desired rather than actual living situations. These purchases frequently result in buyer’s remorse, unworn items accumulating in closets, and budget strain that limits future clothing options or forces compromise on necessary items.

Social media influence represents a growing factor in impulse purchasing behaviors, with targeted advertising, influencer recommendations, and peer pressure driving purchases that may not align with individual needs or budgets. The instant gratification aspect of online shopping, combined with easy return policies that reduce perceived risk, often encourages experimental purchasing that inflates monthly clothing expenses.

Strategic shopping techniques can optimize any budget level through systematic approaches that combine planned and opportunistic elements. End-of-season clearance shopping provides 50% to 70% savings opportunities for consumers willing to purchase next year’s seasonal items in advance. Quality second-hand and consignment purchasing allows access to premium brands at substantially reduced prices while supporting sustainable consumption practices.

Wardrobe capsule development represents another strategic approach that maximizes versatility while minimizing quantity, focusing on timeless pieces that coordinate effectively to create multiple outfit options from fewer individual garments. This approach typically reduces overall clothing needs while increasing cost-per-wear efficiency and daily styling ease.

Subscription services for basics and undergarments provide predictable monthly costs while ensuring consistent replacement of frequently worn items without requiring shopping time or decision-making energy. These services often provide bulk discounts while maintaining quality standards and fit consistency that supports long-term wardrobe planning.

The budget example for single person monthly allocation demonstrates how different spending approaches create dramatically different outcomes within similar income constraints:

| Shopping Approach | Conservative Budget | Moderate Budget | Liberal Budget | Key Characteristics |

| Planned Strategic | $85 | $160 | $285 | Research-driven, seasonal timing, quality focus |

| Mixed Approach | $115 | $220 | $380 | Some planning with occasional impulse purchases |

| Impulse-Driven | $145 | $275 | $475 | Emotion-based, frequent small purchases, trend-focused |

| Budget Variance | 70% | 72% | 67% | Significant impact across all income levels |

Bulk purchasing of frequently replaced items like basic t-shirts, undergarments, and socks provides cost efficiencies while reducing shopping frequency and decision fatigue. However, bulk purchasing requires careful planning to avoid overbuying or selecting items that don’t meet long-term needs.

Generational Spending Patterns: How Age Influences Clothing Investment Priorities

Age represents a significant predictor of clothing spending patterns, with distinct consumption trends across generational cohorts that reflect changing lifestyle needs, income progression, style preferences, and values throughout different life stages. These patterns provide valuable insights for understanding how the average clothes cost per month varies across demographic segments and life transitions.

Young adults aged 18 to 25 typically exhibit higher spending relative to income, often allocating 6% to 8% of earnings toward clothing expenses due to style experimentation, trend following, social pressure, and professional wardrobe establishment needs. This demographic faces unique challenges including limited income, student loan obligations, entry-level professional requirements, and social expectations that encourage fashion-forward choices despite budget constraints. Monthly spending typically ranges from $80 to $150, representing a significant portion of discretionary income but reflecting the importance of personal expression and professional development during this life stage.

The experimentation aspect of young adult clothing consumption involves trying different styles, brands, and fashion trends to develop personal identity and social positioning. This exploration process often results in purchasing mistakes, trend-driven items with limited longevity, and duplicate purchases as style preferences evolve rapidly. However, this experimentation serves important developmental purposes in establishing personal aesthetic preferences and professional presentation skills that provide value beyond pure economic considerations.

Established adults aged 26 to 40 experience peak earning periods that increase budget capacity while developing sophisticated wardrobe management approaches focused on quality and versatility. Professional wardrobe development becomes a priority as career advancement opportunities depend partly on appropriate presentation and industry credibility. Monthly spending typically ranges from $150 to $300, reflecting increased income alongside more strategic purchasing decisions that emphasize long-term value over immediate trend satisfaction.

This demographic often balances multiple wardrobe needs including professional requirements, social occasions, active lifestyle demands, and family responsibilities that require appropriate attire for various contexts. The complexity of wardrobe management increases substantially, requiring organizational skills and strategic planning that support efficient monthly budgeting while maintaining appropriate appearance across diverse life contexts.

Middle-aged adults aged 41 to 55 typically maintain stable wardrobes with selective updates that reflect established personal style preferences and reduced sensitivity to fashion trends. Premium quality preferences become more pronounced as disposable income increases and clothing selection focuses on comfort, durability, and timeless appeal rather than cutting-edge fashion statements. Monthly spending ranges from $120 to $250, often concentrating on replacing worn items with higher-quality alternatives and occasionally updating professional wardrobes to maintain contemporary relevance.

The psychological aspects of middle-aged clothing consumption often emphasize personal comfort and confidence over external validation or trend following. These consumers typically develop strong brand loyalties based on fit, quality, and reliability rather than fashion novelty. Investment in professional appearance maintenance remains important for career security and advancement, but purchasing decisions become more deliberate and research-driven.

Older adults aged 55 and above prioritize comfort and practicality in clothing selection while maintaining appropriate appearance for social and professional contexts. Minimal wardrobe changes reflect established style preferences, physical comfort requirements, and reduced need for variety in clothing options. Monthly spending typically ranges from $60 to $120, focusing primarily on replacing worn items and occasionally updating professional pieces to maintain contemporary appropriateness.

Quality maintenance becomes more important than new purchases as older adults develop appreciation for familiar, comfortable clothing that meets their specific needs without requiring adjustment or adaptation periods. The emphasis shifts toward alterations, repairs, and careful maintenance of existing quality pieces rather than frequent additions to clothing collections.

Healthcare considerations increasingly influence clothing choices as comfort, ease of dressing, and accommodation of physical changes become priorities. These practical considerations may require specific clothing features or adaptations that influence purchasing decisions and budget allocation patterns.

Physical Changes and Wardrobe Adaptation: Managing Size Fluctuations and Life Transitions

Physical changes throughout life create varying clothing replacement needs that significantly impact monthly expenses, requiring strategic planning and budget flexibility to accommodate weight fluctuations, lifestyle changes, health considerations, and aging-related modifications that affect wardrobe functionality and fit requirements. Understanding these adaptation needs enables more accurate long-term budget planning and reduces the financial stress associated with unexpected wardrobe replacement requirements.

Weight fluctuation impacts represent one of the most common and significant factors affecting clothing replacement needs, with different magnitude changes requiring varying levels of wardrobe investment. Minor weight changes of 5 to 15 pounds typically create minimal wardrobe impact, often requiring only minor alterations or strategic styling adjustments to maintain proper fit and appearance. However, moderate changes of 15 to 30 pounds may necessitate partial wardrobe replacement, particularly for fitted clothing items like pants, skirts, blazers, and dresses that rely on precise sizing for professional appearance and personal comfort.

Significant weight changes exceeding 30 pounds typically require complete wardrobe overhauls that can represent 3 to 6 months of normal clothing expenses compressed into short time periods. These situations create substantial financial pressure that requires either budget reallocation from other categories or emergency fund utilization to maintain appropriate professional and personal appearance during transition periods.

Career transitions often require substantial style changes that extend beyond simple dress code modifications to encompass industry culture adaptation, client expectation management, and professional branding considerations. A transition from casual tech industry employment to formal financial services might require completely rebuilding professional wardrobes with higher-quality suits, formal footwear, and appropriate accessories that support credibility and advancement opportunities within new industry contexts.

Pregnancy and post-pregnancy adjustments create predictable but substantial clothing replacement needs that span extended periods and require specialized garment features for comfort, functionality, and professional appearance maintenance. Maternity clothing represents a temporary but necessary investment that serves limited time periods while requiring professional appropriateness and comfort features not found in standard clothing designs.

The post-pregnancy period often involves gradual body changes that may require multiple wardrobe adjustments as individuals return to pre-pregnancy sizes or establish new baseline measurements. This process can extend over 6 to 18 months, requiring flexible clothing options and strategic purchasing decisions that accommodate ongoing physical changes without excessive financial commitment.

Health condition accommodations increasingly require specific clothing features or adaptations that influence purchasing decisions and budget allocations. Conditions affecting mobility may require clothing with easier fastening systems, specific fabric choices for skin sensitivity, or adaptive features that maintain dignity and appearance while accommodating physical limitations.

Activity level changes throughout life affect clothing type requirements and replacement frequency patterns. Increased fitness activities may require expanded athletic wear collections, while reduced physical activity might shift emphasis toward comfortable casual wear with less emphasis on performance features. These lifestyle transitions often require gradual wardrobe adjustments rather than immediate complete replacements.

Budget planning should account for these potential expenses through emergency clothing fund establishment representing 3 to 6 months of normal spending, gradual wardrobe building during stable periods when financial pressure is reduced, strategic investment in adjustable and versatile pieces that accommodate minor changes, and careful timing of major clothing purchases to avoid coinciding with likely transition periods.

Adjustable clothing features like elastic waistbands, wrap styles, adjustable straps, and layering pieces provide flexibility that accommodates minor physical changes without requiring immediate replacement. Investment in these adaptable styles during stable periods creates wardrobe resilience that reduces the financial impact of unexpected changes.

Strategic timing considerations include avoiding major wardrobe investments during periods of likely change such as new fitness programs, medical treatments, career transitions, or life stage changes that might affect body composition or clothing needs. Planning major purchases during stable periods maximizes investment value while reducing the risk of premature replacement requirements.

Professional alteration services can extend the useful life of quality clothing through size adjustments, style updates, and repair services that maintain appearance standards while adapting to physical changes. The cost of alterations often represents substantial savings compared to complete garment replacement, particularly for quality pieces with significant remaining useful life.

Technology and Shopping Evolution: Digital Influences on Modern Clothing Consumption

The digital revolution has fundamentally transformed clothing shopping behaviors and budget management approaches, creating new opportunities for cost savings while introducing fresh challenges in impulse control and purchase decision-making. Understanding these technological influences provides insight into optimizing the budget for single person clothing allocations while leveraging digital tools for improved value and convenience.

Online shopping platforms have democratized access to global fashion markets, enabling consumers to compare prices across multiple retailers instantly while accessing brands and styles previously unavailable in local markets. This expanded access creates opportunities for finding better value through competitive pricing, but it also introduces decision paralysis and increased temptation through constant exposure to new options and promotional messaging.

Price comparison tools and browser extensions automatically identify better prices across multiple retailers, potentially reducing clothing costs by 10% to 30% through strategic purchasing timing and retailer selection. These tools also track price histories, enabling consumers to identify genuine sales versus artificial markdowns while optimizing purchase timing for maximum savings.

Social media advertising has created sophisticated targeting systems that present personalized clothing recommendations based on browsing history, purchase behavior, and demographic profiles. While these systems can introduce consumers to relevant products that meet their needs, they also encourage impulse purchasing through emotional appeals and artificial urgency tactics that can inflate monthly spending beyond planned budgets.

Subscription clothing services offer curated selections tailored to individual preferences, sizes, and budgets while reducing shopping time and decision-making fatigue. These services can provide cost predictability and styling expertise that improves wardrobe coordination, but they may also encourage consumption beyond actual needs through regular shipment cycles and styling pressure.

Virtual fitting technologies and augmented reality applications attempt to address online shopping’s fit uncertainty challenges, potentially reducing return rates and purchase dissatisfaction while improving confidence in online clothing purchases. However, these technologies remain imperfect and cannot fully replicate the experience of physical garment evaluation.

Mobile shopping applications have made impulse purchasing more convenient through streamlined checkout processes, stored payment information, and push notifications that encourage immediate purchase decisions. The ease of mobile shopping can significantly increase monthly clothing expenses through micro-purchases that bypass rational budget evaluation processes.

Digital wardrobe management applications help consumers track existing clothing items, plan outfits, identify wardrobe gaps, and calculate cost-per-wear for informed purchasing decisions. These tools can improve budget efficiency by preventing duplicate purchases while maximizing utilization of existing clothing investments.

The secondary market has expanded dramatically through digital platforms enabling peer-to-peer clothing sales, designer consignment, and rental services that provide access to higher-quality clothing at reduced costs. These platforms create opportunities for both selling unworn items to offset new purchases and acquiring quality pieces at substantial discounts from retail prices.

Influencer marketing through social media platforms has created new forms of fashion pressure and trend acceleration that can drive increased spending on trendy items with limited longevity. However, influencer content also provides styling inspiration and brand discovery that can improve wardrobe efficiency when approached strategically.

Digital loyalty programs and cashback services provide opportunities to reduce effective clothing costs through strategic retailer selection and timing while building toward future purchase discounts. These programs can provide 2% to 10% effective discounts when utilized systematically across regular clothing purchases.

The environmental and social awareness facilitated by digital information access has influenced consumer preferences toward sustainable and ethical fashion choices, often requiring higher upfront investments but providing better long-term value through improved quality and reduced replacement frequency.

Conclusion

The average cost of clothing per month for 1 person varies dramatically based on income level, lifestyle requirements, shopping habits, personal priorities, and life stage considerations. While national averages suggest $120 to $161 monthly spending, individual circumstances can justify anywhere from $50 to $500 or more in monthly clothing expenses, depending on professional requirements, personal values, and strategic approaches to wardrobe management.

Understanding the multiple factors that influence clothing costs empowers individuals to make informed decisions about their clothing budgets while optimizing value and satisfaction within their financial constraints. Whether prioritizing professional advancement, managing tight budgets, building sustainable wardrobes, or navigating life transitions, strategic approaches to clothing expenses can improve both financial outcomes and wardrobe satisfaction.

Successful clothing budgeting requires honest assessment of personal needs, realistic income allocation, strategic shopping practices, and flexibility to accommodate changing circumstances throughout different life stages. By recognizing the factors that drive clothing costs and implementing appropriate strategies, individuals can develop sustainable spending patterns that support their lifestyle goals while maintaining long-term financial health.

The integration of digital tools, sustainable practices, and quality-focused approaches creates opportunities for optimizing clothing budgets while building wardrobes that provide greater satisfaction, versatility, and long-term value than traditional consumption patterns typically achieve.

Frequently Asked Questions

What is the average clothes cost per month for a single person?

The average American spends between $120-$161 per month on clothing, though this varies significantly based on income level, lifestyle requirements, and geographic location. Budget-conscious individuals often spend $60-$100 monthly, while those with higher incomes or professional requirements may spend $200-$400 or more.

How do I create a realistic budget example for single person clothing expenses?

Start by calculating 3-5% of your after-tax monthly income as your clothing budget baseline. Adjust this percentage based on professional requirements, lifestyle needs, and personal priorities. Track your spending for 2-3 months to understand your current patterns, then set realistic targets that accommodate your essential needs while supporting your financial goals. A typical budget might allocate $30-60 for basics, $25-100 for professional wear, and $20-60 for footwear monthly.

What should be included in a comprehensive budget for single person monthly expenses?

A complete clothing budget should include basic apparel replacements, professional wear, footwear, accessories, undergarments, and seasonal items. Allocate roughly 40% to professional/work clothing, 30% to casual basics, 20% to footwear, and 10% to accessories and undergarments. Adjust these percentages based on your specific lifestyle and professional requirements, ensuring coverage for all clothing categories you regularly need.

How can I reduce my clothing cost per month without sacrificing quality?

Focus on strategic shopping practices including buying quality pieces during end-of-season sales, developing a versatile capsule wardrobe, shopping second-hand for designer items, investing in classic styles over trendy pieces, and calculating cost-per-wear before purchasing. Planning purchases quarterly rather than buying impulsively can reduce costs by 20-35%. Additionally, maintain and repair existing clothing to extend its lifespan.

Does age affect how much someone spends on clothes monthly?

Yes, age significantly influences clothing spending patterns. Young adults (18-25) often spend 6-8% of income on clothing while experimenting with style and building professional wardrobes. Peak spending typically occurs between ages 26-40 during career establishment, ranging from $150-300 monthly. Spending generally decreases after age 55 as wardrobes stabilize and comfort becomes prioritized over trends, typically ranging from $60-120 monthly.

Should clothing expenses vary by season throughout the year?

Absolutely. Expect 25-40% variations in monthly clothing costs due to seasonal needs. Autumn and spring typically require higher spending for weather transitions and wardrobe updates. Budget for these fluctuations by setting aside extra funds during lower-spending months (typically winter) to cover higher seasonal expenses like winter coats, boots, or spring wardrobe refreshes.

What factors most significantly impact individual clothing budgets?

Income level is the strongest predictor, typically determining 60-70% of clothing budget variations. Professional requirements can increase costs by 40-80%, while geographic location affects expenses by up to 30%. Personal shopping habits, age demographics, and quality preferences also create substantial variations. Seasonal needs and body changes represent additional factors that can temporarily increase monthly expenses by 25-50% during transition periods.

Robert Martin is a passionate blogger and versatile content creator exploring the intersections of personal finance, technology, lifestyle, and culture. With a strong background in financial literacy and entrepreneurship, he helps readers make smarter money moves, build sustainable side hustles, and achieve financial independence.

Beyond finance, Robert shares his insights on home decor and gardening—offering practical ideas for creating beautiful, functional living spaces that inspire comfort and creativity. He also dives into the dynamic worlds of sports and celebrity news, blending entertainment with thoughtful commentary on trends that shape today’s pop culture.

From decoding the latest fintech innovations to spotlighting everyday success stories, Robert delivers content that’s informative, relatable, and actionable. His mission is to empower readers to live well-rounded, financially confident lives while staying inspired, informed, and ahead of the curve.